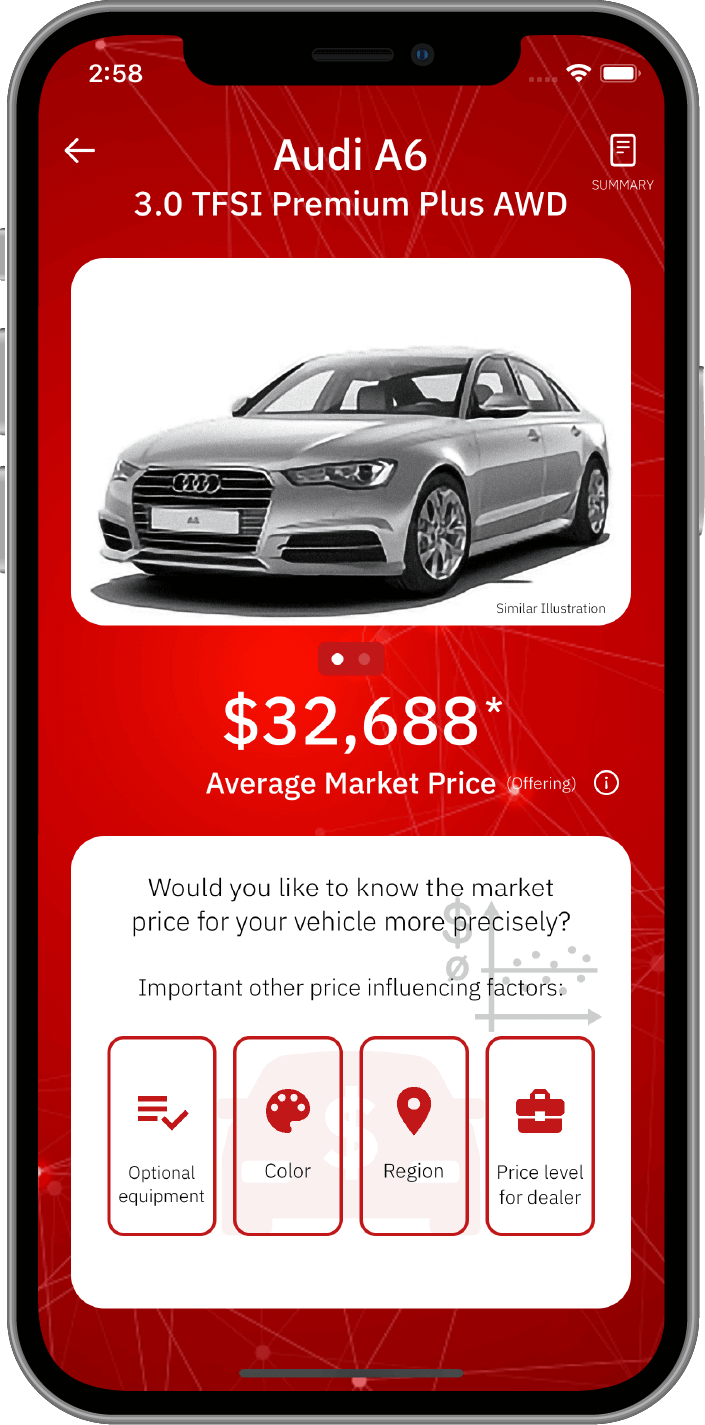

Average Market Price

Calculation of the daily market price, possible for each detail car model (incl. trim-line),

verifying the influence of up to 160 important variables at the same time, such as extras/options, color, region, etc. etc.

Due to the multifold complexity of market price influences acting at the same time,

very modern mathematical technologies are used.

Your benefit: More security by knowing exactly the provable vehicle market value for your car

(determined directly by the market, not by so called ‘expert-opinions’).

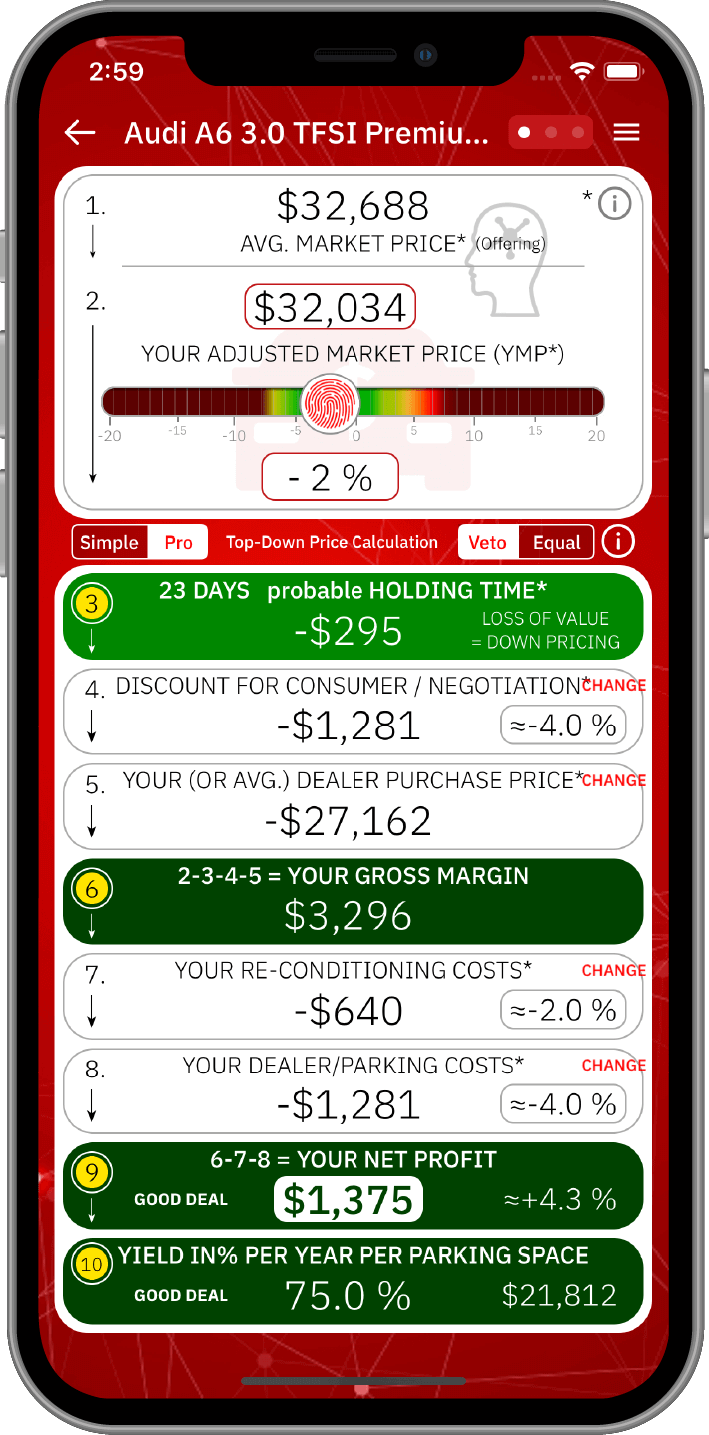

Optimal Market Price

Multi-interest decision optimum, by step-simulation (see the colored thumb-slider on the top)

Optimal decisions result by optimal balancing the multi-sales-interests

(Sales-interests: Step 3: “Speedy Gonzales”, Step 6: “Max Gross Margin”,

Step 9: “Max Profit/car” and Step 10: “% Return on Invest p.a./park”)

Step 1 : Only passive information: Average current market price for this car (you can find more information in the other app product: Average Market Price).

Step 2 : Your desired market price positioning for this car. You can move the slider to the left (minus x % below the average market price) or to the right (plus x % above the average market price).

Step 3 : Probable holding time: The current average holdingtime for your vehicle model until it gets sold is determined depending on your individual %-market price positioning … On this basis, the expected loss in value of your vehicle is determined on the basis of market trend analyzes and forecasts for your vehicle model.

Step 4 : Average customer negotiation discount (can be individually adjusted either in percent or in absolute value. In addition, an intelligent-case can be selected: Only little discount for offer position below the market price and above-average discount for offer position well above the market price. All these adjustments as a paid service).

Step 5 : Your (or, by default the average) dealer purchase price (DPP): Here we show the DPP for the vehicle you have selected *. This should give you an orientation. Usually as a dealer, you have already bought this vehicle and want to use this analysis tool to determine the optimal market price (OMP, the offer price which gives you the best profit per vehicle), which of course also depends on your individual DPP level and can therefore be entered or overwritten individually by you … because if you made a particularly cheap purchase, your gross margin will of course increase significantly (see next steps).

Step 6 : Your gross margin = Step 2 – Step 3 – Step 4 – Step 5 : Depending on the slider position, your proportionally increasing or decreasing gross income (= gross margin) is calculated => your desired offer price – minus the necessary price reduction due to the loss of value in for the probable holdingtime – minus the typical buyer negotiation discount – minus your individual trade-in purchase price (DPP) or the average current market procurement price of the vehicle ( dealer purchase price = DPP) … results into your gross margin, depending on your %-market price position.

Step 7 : Your reconditioning costs: Typical costs for the overhaul / reconditioning of the car, typical dealer standard values such as vehicle cleaning, reconditioning, small repairs, inspection, fresh state technical vehicle inspection, etc. The reconditioning costs for this vehicle can either be specified as a flat rate in % or alternatively, adjusted in absolute EU/GBP/USD value. Alternatively, you can click on an intelligent comprehensive, and much more precise cost… All these adjustments as a paid service.

Step 8 : Your dealer overhead and parking lot costs: Then the allocation of your costs for your trading enterprise will be calculated, e.g. salesman commission, interest rates, parking lot costs, etc. The dealer-related costs for this vehicle can either be specified as a flat rate in % value or, alternatively be adjusted in absolute EU/GBP/USD value. You can also click on an intelligent, comprehensive and much more precise cost calculation. All these adjustments as a paid service.

Step 9 : Your net profit per car = Step 6 – Step 7 – Step 8: As a result, you get profit values in the background depending on each of the individual market price positions. The profit values can be positive (= profit) in certain areas … but negative (loss) in other areas. For each % market price positioning of your vehicle (see the coloured slider with fingerprint shown above) for this important commercial interest field, your individual profit is determined (income – expenditure, via all previous steps / decision fields in all their complexity and with all their individually adjustable parameters).

Step 10 : Your return on capital in% p.a. per parking space (return in% per year per parking space): For this step / decision field, the individual return (profit) in euros is multiplied by the achievable turnover rate per year for this single trade example. This annual total return is then set in relation to the capital employed and thus results in the annual return on the capital employed. This return on capital is seen by investors in comparison to alternative investments.

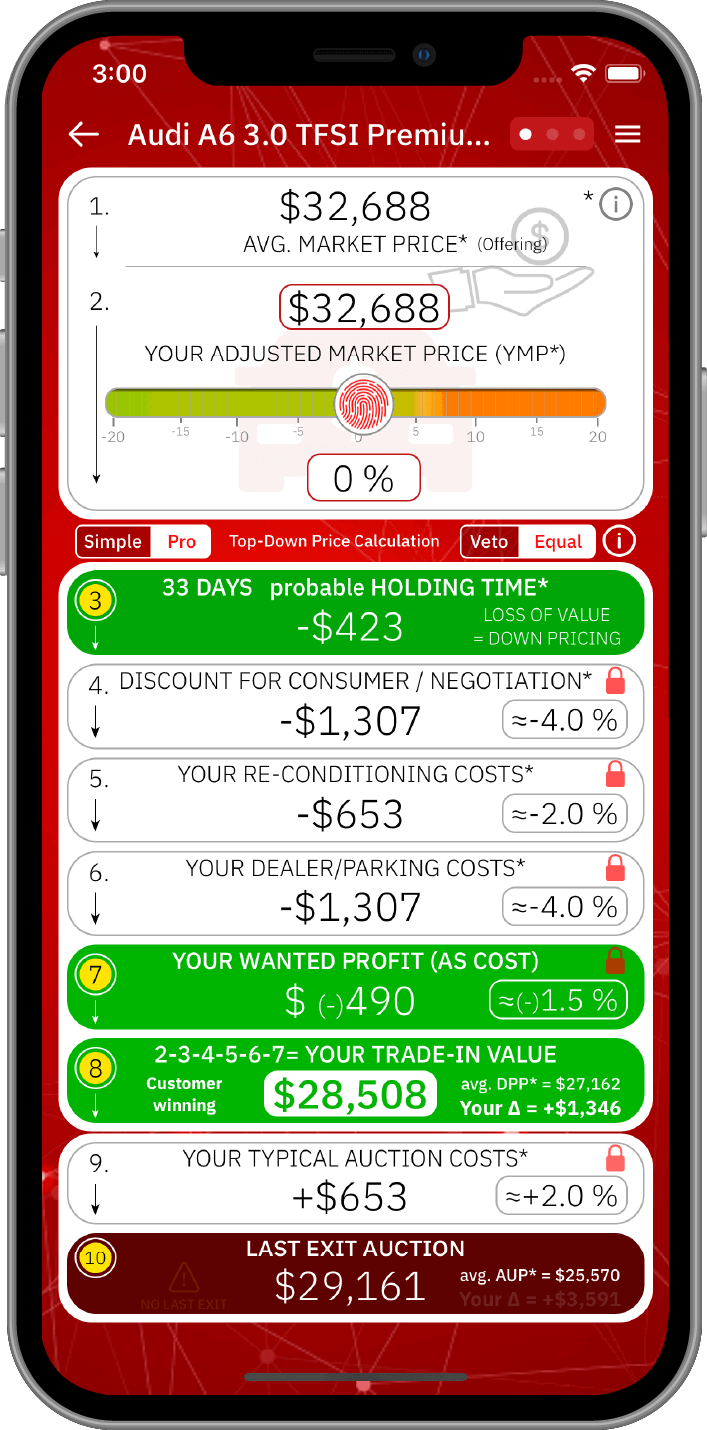

Optimal Dealer Trade-In Price

Multi-interest decision optimum, by step-simulation (see the colored thumb-slider on the top)

Optimal decisions result by optimal balancing the multi-purchase-interests

(Purchase-interests: Step 3: “Speedy Gonzales”, Step 7: “Profit/car”,

Step 8: “Competitive DPP” (DPP = Dealer Purchase Price) and Step 10: “Risk of Last Exit Auction”)

Step 1 : Only passive information: Average current market price for this car (you can find more information in the other app product: Average Market price).

Step 2 : Your desired market price positioning for this car. You can move the slider to the left (minus x % below the average market price) or to the right (plus x % above the average market price).

Step 3 : Probable holding time: The current average holdingtime for your vehicle model until it gets sold is determined depending on your individual %-market price positioning … On this basis, the expected loss in value of your vehicle is determined based on market trend analyzes and forecasts for your vehicle model.

Step 4 : Average customer negotiation discount (can be individually adjusted either in percent or in absolute value. In addition, an intelligent-case can be selected: Only little discount for offer position below the market price and above-average discount for offer position well above the market price. All these adjustments as a paid service).

Step 5 : Your reconditioning costs: Typical costs for the overhaul / reconditioning of the car, typical dealer standard values such as vehicle cleaning, reconditioning, small repairs, inspection, fresh state technical vehicle inspection, etc. The reconditioning costs for this vehicle can either be specified as a flat rate in % or alternatively, adjusted in absolute EU/GBP/USD value. Alternatively, you can click on an intelligent comprehensive, and much more precise cost calculation … All these adjustments as a paid service.

Step 6 : Your dealer overhead and parking lot costs: Then the allocation of your costs for your trading enterprise will be calculated, e.g. salesman commission, interest rates, parking lot costs, etc.The dealer-related costs for this vehicle can either be specified as a flat rate in % value or, alternatively be adjusted in absolute EU/GBP/USD value. You can also click on an intelligent comprehensive, and much more precise cost calculation. All these adjustments as a paid service.

Step 7 : Your desired profit per car (calculated as costs): Of course, a commercial transaction should usually be profitable. The dealer therefore calculates a planned net margin or profit for the purchased vehicle. This can either be included in the top-down calculation as a flat rate in % or, alternatively, as an absolute EU/GBP/USD value. The default is set to 2% profit per car. All these adjustments as a paid service.

Step 8 : Your dealer trade-in price (= dealer purchase price DPP) as the logical top-down calculation for this car based on the previous steps: Step 2 – Step 3 – Step 4 – Step 5 – Step 6 – Step 7 = Step 8. The color of this step shows the competitiveness of your DPP. If your top-down calculated DPP is significantly below the average DPP from other dealers, you take the risk that the customer will sell his car to another dealer … and you may also lost the new car business … and that lost the after-sales/repair business from that customer.

Step 9 : Your Typical Auction Costs: If you plan to buy or sell a car at the auction, there are additional costs: 1) Transport costs of the car to the auction. 2) Auction fees. 3) Dont forget that the buyers of an auction are interested in a bargain / low price so that it makes sense for these dealers to bring the vehicle to their dealership with their additional sales and margin costs. These costs can be adjusted in % or in absolute EU/GBP/USD value as a paid service.

Step 10 : Last Exit Auction: In the event that the dealer was not able to sell the car in the planned time at the planned price in the consumer market … despite this good and exact top-down market price calculation … then in step 9 the additional auction costs would have to be added in order to ship the car to its last exit, the auction … consequently in step 10 the wanted/resulting auction price level for this vehicle is shown which would have to achieved according to its top-down cost calculation … if the dealer wants / has to sell this car at the dealer auction.

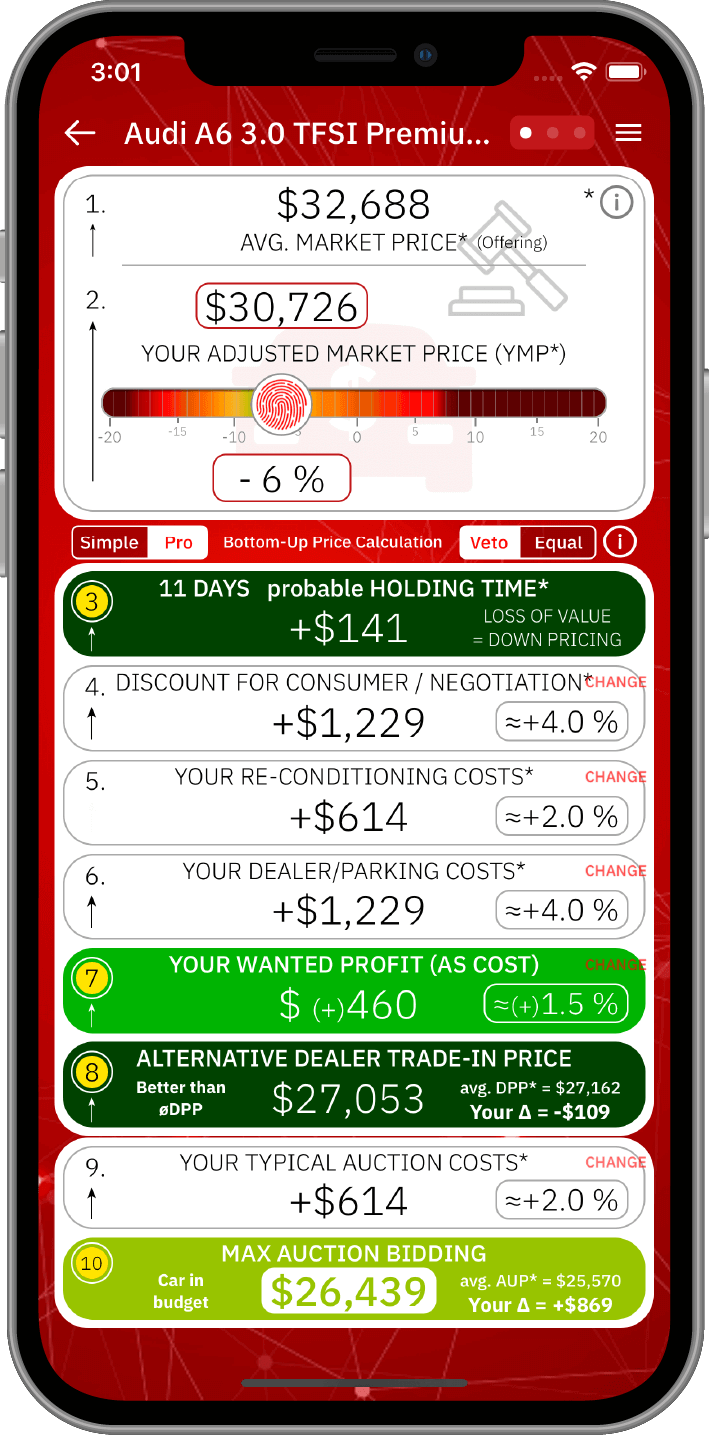

Opt. / Max. Auction Bidding

Multi-interest decision optimum, by step-simulation (see the colored thumb-slider on the top)

Optimal decisions result by optimal balancing the multi-purchase-interests

(Purchase-interests: Step 3: “Speedy Gonzales”, Step 7: “Profit/car”,

Step 8: “Alternative typ. Dealer Purchase” and Step 10: “Auction Mission Accomplished”)

Step 1 : Only passive information: Average current market price for this car (you can find more information in the other app product: Average Market price).

Step 2 : Your desired market price positioning for this car. You can move the slider to the left (minus x % below the average market price) or to the right (plus x % above the average market price).

Step 3 : Probable holding time: The current average holdingtime for your vehicle model until it gets sold is determined depending on your individual %-market price positioning … On this basis, the expected loss in value of your vehicle is determined based on market trend analyzes and forecasts for your vehicle model.

Step 4 : Average customer negotiation discount (can be individually adjusted either in percent or in absolute value. In addition, an intelligent-case can be selected: Only little discount for offer position below the market price and above-average discount for offer position well above the market price. All these adjustments as a paid service).

Step 5 : Your reconditioning costs: Typical costs for the overhaul / reconditioning of the car, typical dealer standard values such as vehicle cleaning, reconditioning, small repairs, inspection, fresh state technical vehicle inspection, etc.. The reconditioning costs for this vehicle can either be specified as a flat rate in % or alternatively, adjusted in absolute EU/GBP/USD value. Alternatively, you can click on an intelligent comprehensive, and much more precise cost … All these adjustments as a paid service.

Step 6 : Your dealer overhead and parking lot costs: Then the allocation of your costs for your trading enterprise will be calculated, e.g. salesman commission, interest rates, parking lot costs, etc. The dealer-related costs for this vehicle can either be specified as a flat rate in % value or, alternatively be adjusted in absolute EU/GBP/USD value. You can also click on an intelligent comprehensive, and much more precise cost calculation. All these adjustments as a paid service.

Step 7 : Your desired profit per car (calculated as costs): Of course, a commercial transaction should usually be profitable. The dealer therefore calculates a planned net margin or profit for the purchased vehicle. This can either be included in the top-down calculation as a flat rate in % or, alternatively, as an absolute EU/GBP/USD value. The default is set to 2% profit per car. All these adjustments as a paid service.

Step 8 : For side information only: Your alternative dealer trade-in price (= dealer purchase price DPP) for this car as a logical top-down calculation based on all previous steps: Step 8 = Step 2 – Step 3 – Step 4 – Step 5 – Step 6 – Step 7. The coloring of this step (8) shows the competitiveness of your maximum auction price (step 10) plus the necessary auction transaction costs (step 9) in comparison to the alternative purchase via the normal dealer trade-in price respectively the dealer purchase (DPP).

Step 9 : Your Typical Auction Costs: If you plan to buy or sell a car at the auction, there are additional costs: 1) Transport costs of the car to the auction. 2) Auction fees. 3) Dont forget that the buyers of an auction are interested in a bargain / low price so that it makes sense for these dealers to bring the vehicle to their dealership with their additional sales and margin costs. These costs can be adjusted in % or in absolute EU/GBP/USD value as a paid service.

Step 10 : Max Auction Bidding: Your maximum auction bid / maximum purchase price for the vehicle currently offered at the B2B dealer auction: Based on all previously calculated steps … top-down calculated based on the optimal consumer market price and taking into account all important decision criteria (e.g. short holdingtime and reaching at the min wanted profit / vehicle) as well as all incurred and to be planned costs.